General Claims Procedure

All insurance contracts are based on the information provided by the Policy holder while buying Insurance and the Insurance Policy. Some important points, which would help you in the claims procedure:- The loss or damage should be reported to the Insurance Company and your Insurance Broker (care@policy99.com) for assistance immediately. Please do inform us the Insurance Policy number while intimating for speedy attention.

- Claim form can be downloaded from your broker’s site www.policy99.com under “Form Download” section or the Insurance Company’s site. In case it is not available please let us know so that we can arrange to send you the claim form immediately.

- Please arrange to submit the completed claim form along with an estimate of the loss to the Insurance Company. It is preferable to submit an itemized estimate with separate values.

- The Insurance Company will arrange for inspection of the damaged items to assess the loss. In case of major losses, a specialist-licensed surveyor is deputed.

- The Policy holder has to provide the required documents to substantiate the cause & extent of loss.

- In case the cause of loss is not established, it is for the Policy holder to prove that the loss or damage has occurred due to an insured peril.

- On agreement of claim amount between the Insurance Company and the Policy holder, the claim is settled as per the terms and condition of the policy.

- Excess (Deductable) as stated as per the Policy terms and condition will be deducted from the claim payable.

- Once the claim is approved, Discharge voucher, Aadhaar Number , PAN Number , Cancelled cheque leaf of the Insured will be required by the Insurance Company to transfer the claim amount

Motor vehicle (Private car & two wheelers) claims

Claims under Motor policies- Notice of an accident should be reported to the Insurance Company and your Broker.

- The Policy holder may be interested to pay compensation without going into whether he is liable to pay or not. It is therefore an express condition of the policy that no claim should be admitted or a compromise arrived at, without the approval of the Insurance Company.

- In case of major claims, the Insurance Company may be willing to defend criminal case against the driver also on the basis of which compensation claims may be decided in the civil courts.

Every accident involving third parties is required to be reported to police. MV Act provides that a third party victim can proceed against the Insurance Company directly. If the alleged accident is not reported to the Insurance Company, the Insurance Company can consider this as violation of policy condition. In such circumstances, even if Insurance Companies are required to pay compensation by a court of law, they have an option of recovering such claim amounts from the policy holder for violation of specific policy condition.

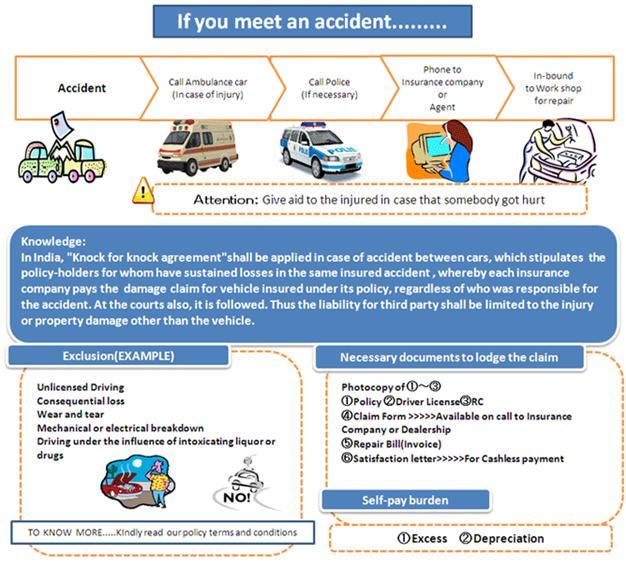

Steps to be taken in case of an accident:

- Notice of accident should be filed with the Insurance Company and the Insurance Broker for assistance.

- If damage is a major one, the accident may be reported before the vehicle is removed from the spot so that the Insurance Company can arrange for spot inspection of damage.

- Try to take photographs of the vehicle from the accident spot from your Camera/Mobile if possible.

- The vehicle may then be moved to a workshop, preferably to authorized workshop, for estimation of repair charges.

- Accumulated claims are not entertained by most of the Insurance Companies.

- In case the vehicle needs to be towed, the invoice and the proof of payment need to be submitted for reimbursement as per the terms and conditions of the policy.

- On receipt of completed claim form and estimate of repairs the Insurance Company will arrange detailed inspection of damage and cost of repairs will be ascertained.

- The Insurance Company will ensure that a person duly licensed drove the vehicle at the time of accident and that the vehicle is the one insured in their books. To that end, they will verify the Registration Certificate and the Driving license of the driver who drove at the time of the accident.

- Upon completion of the above procedure, the repairers will be authorized to carry out repairs. The Insurance Company may undertake to settle the repair bills directly with the garage or reimburse the policy holder after submitting the relevant documents without any delay.

Motor claims Check list:

- Immediate Intimation

- Spot photograph by the policy holder if possible

- Claims form to be duly filled and signed by the Insured

- Insurance Policy copy

- Verification of Original RC and Driving license along with a photo copy.

- Vehicle inspection by Surveyor appointed by Insurance Company

- Repairs can be done only after the surveyor inspects the damaged vehicle

- Itemized estimate of Repairs with separate values

- Copy of FIR/Panchnama is required for TP injury/death/property damage

- Re inspection of the vehicle after repairs and before delivery from the workshop to be done by the surveyor

- Payment receipt for non cashless claim

- Original repair invoice for cashless claims

- AML documents for amount more than Rs 1 Lac (PAN card,2 passport sixe photo, residence proof)

- Form 35 or original NOC from financier incase of total loss where payment is made to the Insured

- Company PAN Card & GST certificate if the insured vehicle is in the name of company

- Cancelled cheque leaf

-

Additional documents in case of Theft:

· Copy of FIR & Non traceable certificate from the police

· All Original keys & vehicle invoice copy

· Intimation to RTO for theft of vehicle

· Duly signed RTO transfer papers(Form 26,28,29,30,35)

· RC extract with stolen remark from the concerned RTO after the loss

· Deed of subrogation cum indemnity on judicial stamp paper

Medi claim (for non-cashless claims)

- Notice of claim should be lodged within 24 hours to the Insurance Company and your Broker for assistance

- The Policy holder should submit ‘discharge summary’ of the hospital/nursing home along with original hospital/medical bills, reports of the labs, investigation reports and Doctors prescriptions. In other words every item in the claim bill should be supported.

- Leave certificate from the employer, wherever needed.

- Fitness certificate from the Doctor.

Travel Insurance claims

- The claim procedure varies from country to country and therefore the Policy holder should get in touch with the overseas claim settling agents of the Insurance Company immediately.

- The Policy holder should carry the policy document with him/her, which may be produced as evidence if necessary. The policy document also contains the full information as to how to get in touch with the claim settling agents for assistance.

Personal Accident Claims

- Immediate notification to the Insurance Company and your Broker for assistance

- In case of accidental death, the capital sum is paid to the legal nominee/assignee of the Policy holder. If the Policy holder fails to provide the name of the nominee, succession certificate from a court of law is necessary.In case of other claims, the Insurance Company may get the Policy holder examined by a specialist or refer the matter to medical board as is necessary, the cost of which will be borne by the Insurance Company.

Burglary Claims / Money Insurance / Fidelity

- Immediately report to the police and obtain a non-traceable certificate if the items are not found.

- Notify Insurance Company as early as possible.

- The Insurance Company will insist upon a letter of undertaking on a stamp paper of appropriate value – letter of Subrogation, for refunding the claim amount when the stolen property is recovered.

- Obtain a final report from Police and submit the same to the Insurance Company

- Policy holder has to provide the surveyor complete book of accounts and bills substantiating the loss on the day of incidence.

Machinery Breakdown Claims

- Immediate notification to the Insurance Company and your Broker for assistance

- Notice of claim and estimated cost of repairs should be filed with the Insurance Company to arrange for survey / inspection.

- In case of partial losses, no depreciation is charged but when the items are not insured for its present day replacement value, the items are treated as underinsured and the claim amount is proportionately reduced. Depreciation is only applied for Total Loss claims.

- If machinery is partially damaged, it should be repaired (on approval from insurance company) before it is put to use, as otherwise further loss is not covered.

Electronic Equipments Insurance Claims

- Immediate notification to the Insurance Company and your Broker for assistance

- Notice of claim and estimated cost of repairs should be filed with the Insurance Company to arrange for inspection.

- In case of partial losses, No deduction shall be made for depreciation in respect of parts replaced, except those with limited life, but the value of any salvage will be taken into account.

- If an appliance is partially damaged, it should be repaired (on approval from insurance company) before it is put to use, as otherwise further loss is not covered

Marine Transit Loss Claims

- Original Invoice & packing List – if forming part of Invoice

- In case any damage is suspected in transit, open delivery should be insisted upon the carrier and their certificate should be obtained.

- Surveyor’s inspection of the damaged / lost / shortage cargo

- Original Lorry receipt (LR)/ Bill of Lading (BL)- Qualified with remarks for the Quantity damaged or lost in the transit.

- In case of Declaration Policy – The consignment should be declared within the limit of balance Sum insured.

- In case of loss/damage in transit, a monetary claim should be lodged with the carrier within the time limit to protect recovery rights.

- Damage / Shortage Certificate from the carrier.

A surveyor ( mutually agreed by the Insurer) must be appointed to determine the nature, cause and extent of loss/damage

Redressed System of Policyholder’s Grievances

Disputes do arises under the insurance policies either due to repudiation of claims or payment of claim amount not as per the claim bill filed. To resolve these issues, many options are available to the policyholders as under:- Complaint may be filed with the Insurer

- Integrated Grievance management System (IGMS)

- File a Complaint with Ombudsman

- File a legal case under Consumer protection Act 1986

- Approach the Grievance Redressal Officer of its branch or any other office that you deal with.

- Give your complaint in writing along with the necessary support documents

- Take a written acknowledgement of your complaint with the date.

- The insurance company should deal with your complaint within 15 days.

- If that does not happen or if you are unhappy with their solution you can :Approach the Grievance Redressal Cell of the Consumer Affairs Department of IRDA : Call Toll Free Number 155255 (or) 1800 4254 732 or Send an e-mail to complaints@irda.gov.in

- Register and monitor your complaint at igms.irda.gov.in or compliant form (Click here) may also be to IRDAI at Hyderabad

Any Individual or Business Entity can file a complaint with the following consumer courts:

- District Forum for the claim amount up to Rs 20 lakhs

- State Commission for the claim amount more than Rs 20 lakhs but up to Rs 100 lakhs

- National commission for the claim amount exceeding Rs 100 Lakhs

Though there is not Stamp duty to file a complaint but nominal amount of Court fees is to be deposited while filing a complaint.

The appeal can be filed with the Higher Commission for the decision of the District forum, State forum and after National Commission the appeal lies with the Hon’able Supreme Court.

Toll free Number for Claim Registration of respective Insurance Companies

| Name of the Ins.Co. | Toll free and Mail ID | ||||

|---|---|---|---|---|---|

| Motor | PA/GPA | Travel | WC | Health | |

| ACKO | 18602662256 | NA | NA | NA | NA |

| Bajaj Alliance | 1800 209 5858 1800 209 7272 |

1800 233 7272 | NA | NA | 1800 209 5858 1800 209 7272 |

| Bharti Axa | 1800-103-2292 | 1800-103-2292 | 1800-103-2292 claims@bharti-axagi.co.in | 1800-103-2292 | 1800-103-2292 |

| Chola Mandal | 1800 44 5544 | NA | NA | NA | 1800 44 5544 |

| Cigna TTK | NA | 1800-102-4462 | NA | NA | 1800-102-4462 |

| Future Generali | 1800 22 0233 | 1800 209 1016 | 1800 209 233 fgi@europe-assistance.in |

1800 22 0233 | 1800 209 1016 1800 103 8889 |

| HDFC Ergo GIC LTD | 1800 200 1999 | 1800 270 0700 | 022-62346234 / 0120-62346234 travelclaims@hdfcergo.com |

8169 500 500 | 022-62346234 / 0120-62346234 healthclaims@hdfcergo.com |

| ICICI Lombard | 1800 2666 | 1800 2666 | NA | NA | 9223622666 1800 2666 |

| IFFCO TOKIO | 1800-103-5499 | 1800-103-5499 079 – 2676 8062 / 63 |

0222-7729956 / 58 – Miss. Yogita | 1800-103-5499 | 1800-103-5499 |

| Liberty Videocon | 1800 266 5844 | 1800 266 5844 | NA | 1800 266 5844 | 1800 266 5844 |

| Magma HDI | 1800 3002 3202 | 1800 3002 3202 | NA | NA | 1800 3002 3202 |

| National | 1800-11-4000 | 1800-11-4000 | 1800-11-4000 | 1800-11-4000 | 1800-180-1104 |

| New India | 1800 209 1415 | 1800 209 1415 | 1800 209 1415 | 1800 209 1415 | 1800 102 6425 1800 209 1415 |

| Oriental | 1800 11 8485 1800 425 2002 |

NA | NA | 1800 11 8485 | 1800 425 2002 |

| Reliance | 1800 3009 | 1800 3009 | 1800 209 5522 reliance@europe-assistance.in |

1800 3009 | 1800 3009 |

| Religare | NA | 1860-500-4488 | NA | NA | 1800-200-4488 |

| Royal Sundaram | 1860-425-0000 | 044-7117 7117 | customer.services@royalsundaram.in. | 044-7117 7117 | 044-7117 7117 |

| SBI | 1800 22 1111 | 1800 22 1111 | customer.care@sbigeneral.in | 1800 22 1111 | 1800 102 1111 1800 209 0221 022-66620808 |

| Star Health | NA | 1800 102 4477 | NA | NA | 1800 425 2255 |

| TATA AIG | 1800 266 7780 | 1800 425 4090 1800 266 7780 |

customersupport@tata-aig.com | 1800 266 7780 | 1800 425 4033 1800 103 5252 |

| United India | 1800 425 33333 | NA | NA | NA | 1800 425 33333 |

| Universal Sompo | 1800 22 4030 | 1800 22 4030 | 1800 22 4030 | 1800 22 4030 | 1800 22 4030 |

Turn Around Time (TAT) – Related to Insurance survey report

| Notification of Loss / Intimation of Loss | Immediately after the Accident / Occurrence. ( Within reasonable time limit) |

| Appointment of Surveyor by Insurer / Insured | 72 hours from the date of receipt of intimation. |

| Submission of Survey Report | 1 Month from the date of appointment by the Insurer / Insured. In case of Special & Complicated nature of claim under intimation to the Insured. The time limit is extended to 6 months. |

| Addendum Report | 3 Weeks from the date of receipt of communication from the Insurer. |

| Request for Addendum Report by the Insurer | In case of incomplete in any respect in the Survey Report Insurer may seek additional report from the Survey with in 15 days from the date of receipt of Survey Report. It is allowed only once. |

| Settlement / Rejection of claim by the Insurer | 30 days from the date of receipt of Survey Report / Additional Report from the Surveyor. |